Templar Energy and Tapstone Energy executed an Asset Purchase Agreement (APA) dated June 22, 2020, according to case records examined online. Tapstone’s offer of $65 Million will serve as the “Stalking Horse Bid,” and Tapstone is positioned to receive a $1.95 million termination fee should another offer be chosen by Templar at July’s bankruptcy auction.

- Templar Energy filed for chapter 11 bankruptcy on June 1, 2020.

- Tapstone Energy completed financial restructuring on April 20, 2020. Tapstone received a four-year secured term loan of approximately $145 million. Additionally Kennedy Lewis Investment Management, LLC is investing $50 million of new capital in the form of preferred equity in Tapstone to pursue acquisitive growth in the Mid-Continent region.

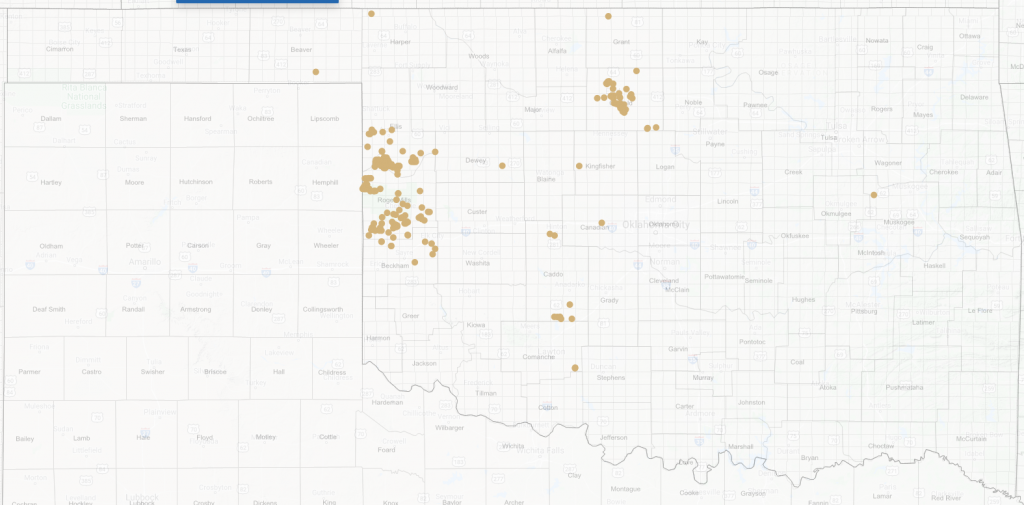

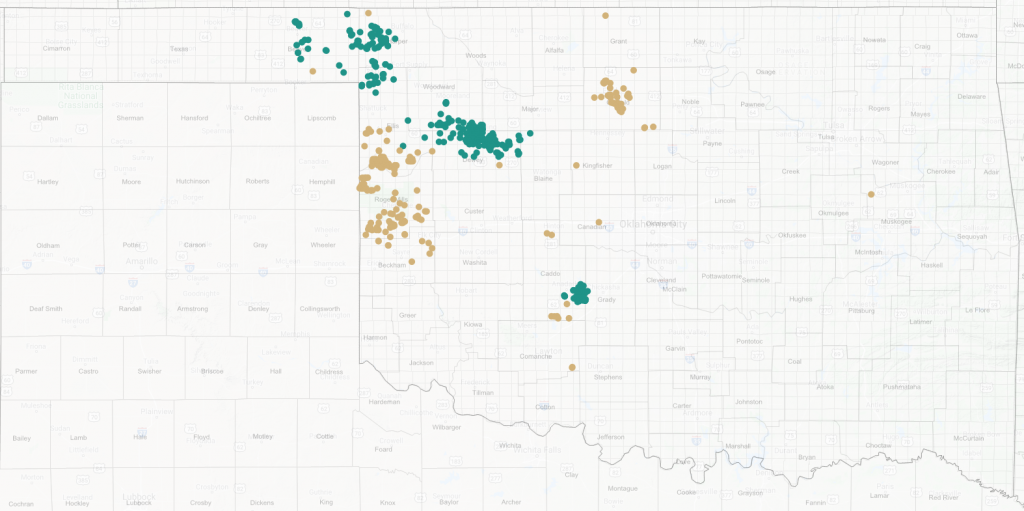

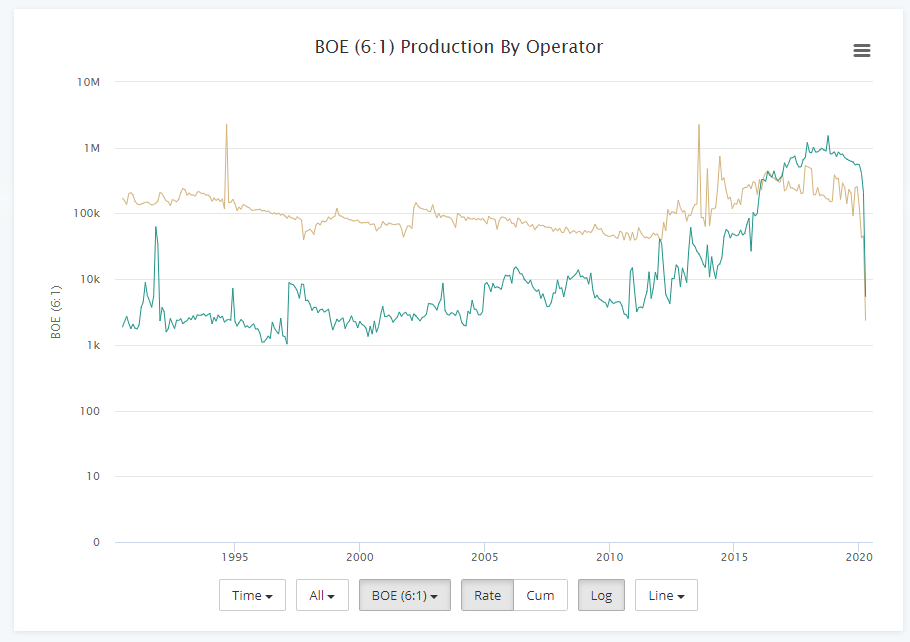

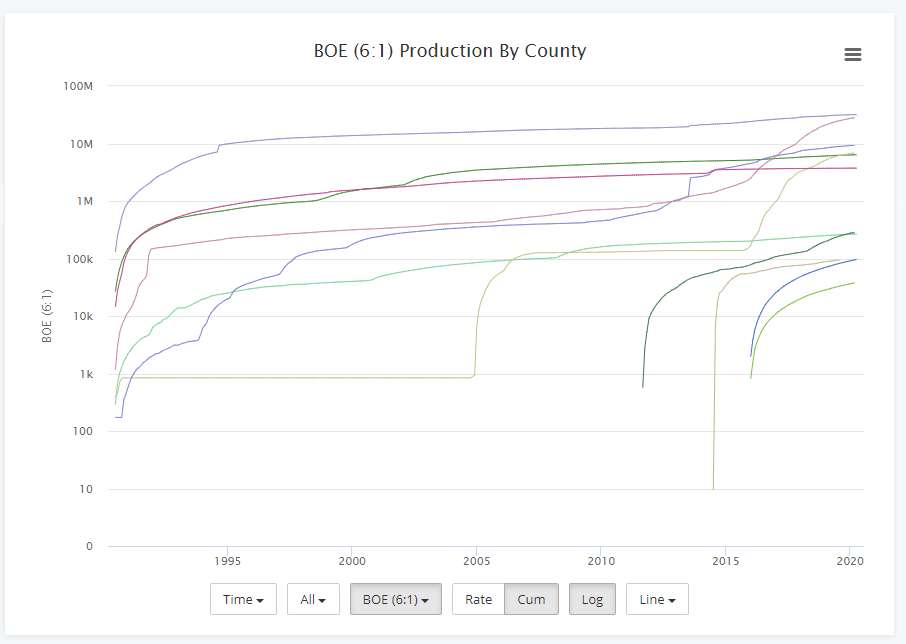

We dove deeper into this potential transaction to get better insights into Templar and Tapstone’s current assets with the help of WellDatabase’s easy to use platform.

Stay up-to-date with Oklahoma oil and gas activity by subscribing to our free newsletter. And schedule a demo to see our Land, Regulatory, and Well Data and Analytics platform in action!

Comments are closed