Last month we wrote that Templar Energy and Tapstone Energy executed an Asset Purchase Agreement (APA) of $65 Million to serve as the “Stalking Horse Bid,” and Tapstone was positioned to receive a $1.95 million termination fee should another offer be chosen by Templar at July’s bankruptcy auction.

According to the bankruptcy files, Presidio Investment Holdings LLC was the successful bidder at the auction, that its bid was the highest and best bid for the assets. The purchase price of the Successful Bid was $91 Million less the Transaction Fee and Expense Reimbursement of $1,950,000, and $350,000 respectively.

The press release noted that Presidio Petroleum is a portfolio company, majority-owned by investment funds managed by Morgans Stanley Energy Partners.

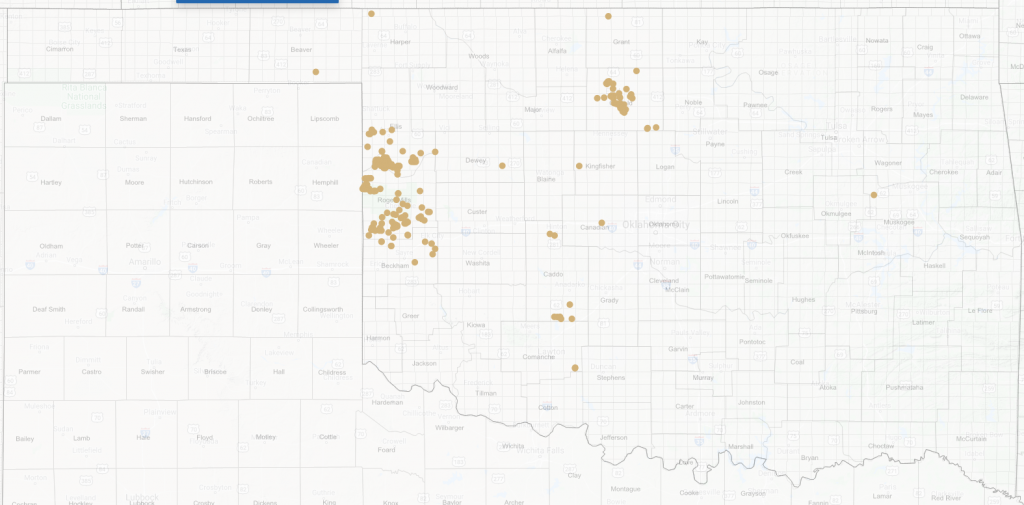

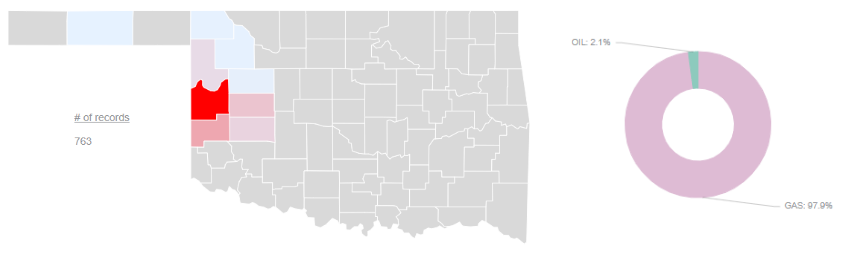

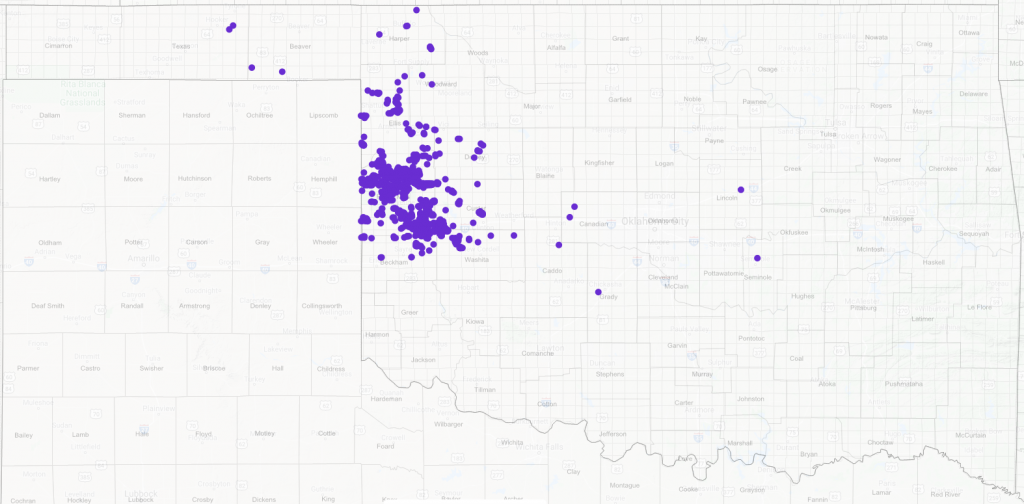

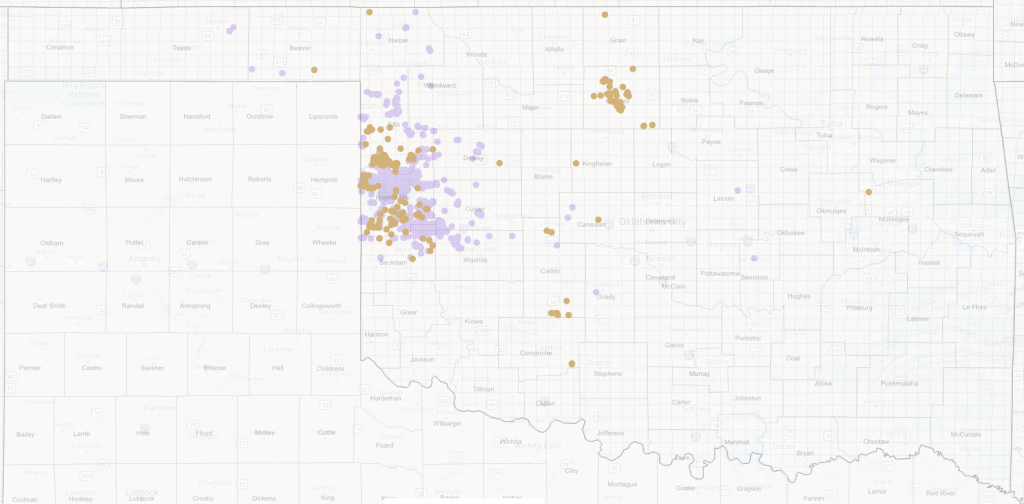

According to the press release, this is the third acquisition by Presidio since 2018. According to Convey640 well transfer data, Presidio acquired 763 wells from Apache Corporation back in July 2019.

Chris Hammack, Co-Founder and Co-Chief Executive Officer of Presidio Petroleum said, “This acquisition is a logical extension of the asset optimization strategy we established upon founding Presidio, and we are excited to apply the knowledge gained from our previous two acquisitions in the Basin and decades of operational experience to unlock value responsibly from the Templar asset.”

Stay up-to-date with Oklahoma oil and gas activity by subscribing to our free newsletter. And schedule a demo to see our Land, Regulatory, and Well Data and Analytics platform in action!

Comments are closed