For this blog, we examined public mineral deed records in 31 counties. The charts and maps below are powered by data from our mineral & leasehold intelligence platform, Convey640, which uses advanced computer technology to gather, clean, and organize regulatory, land, and well data into a single platform. This blog is meant to be informative and is not intended for investment advice. If you have any questions or would like to learn more about Convey640, please contact me at ctucker@conveyenergyok.com.

WHERE

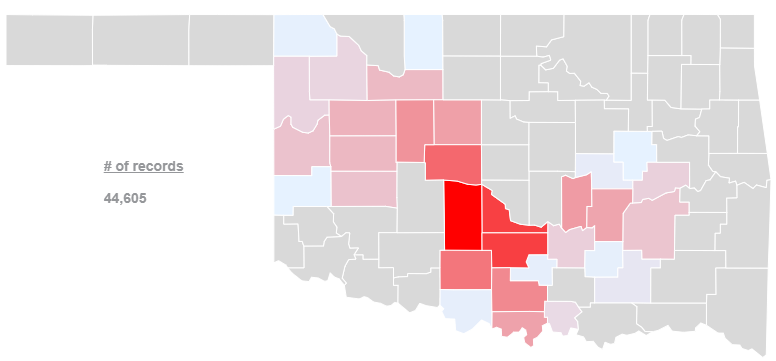

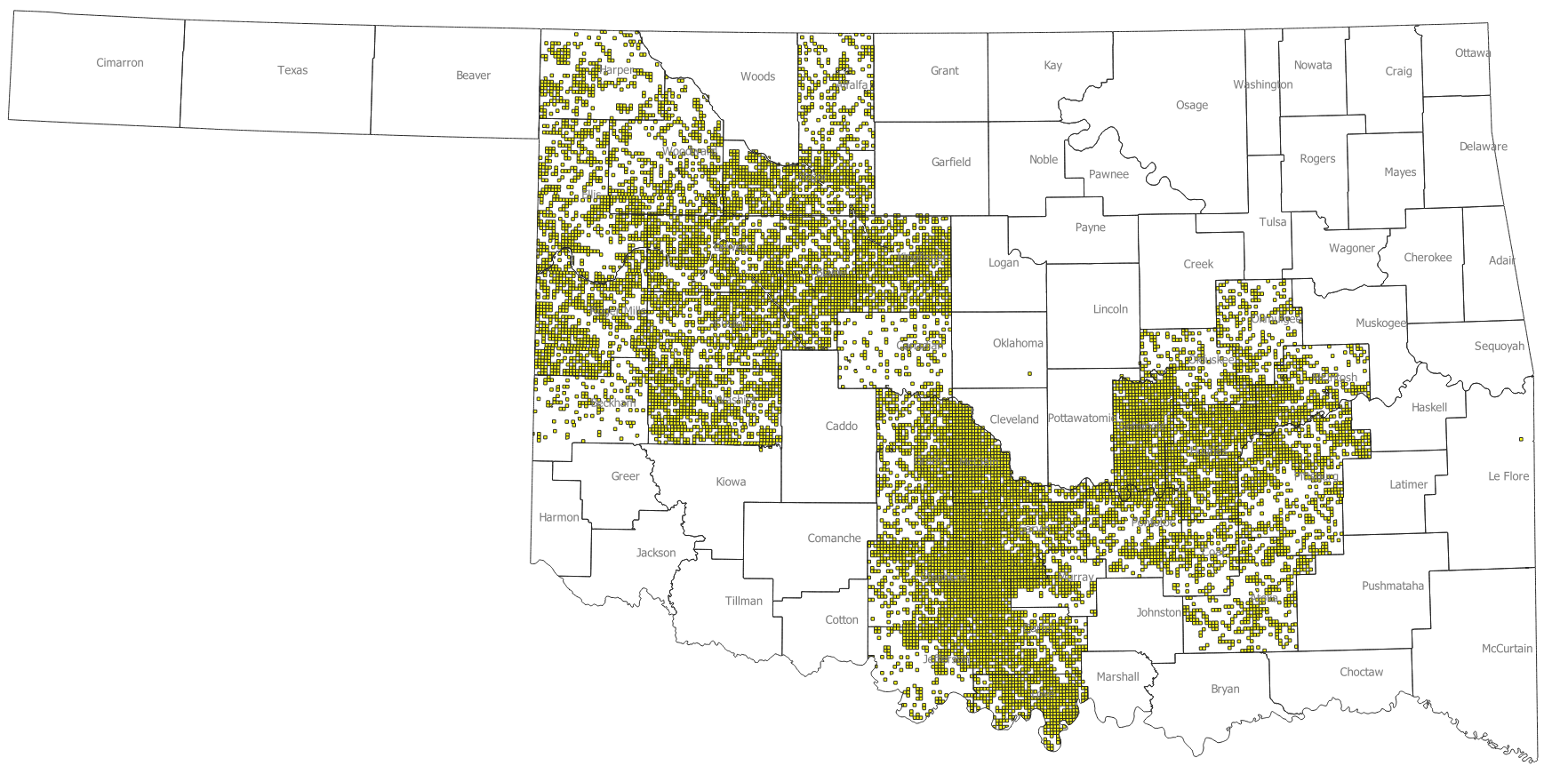

Most mineral buying occurred in the Anadarko and Arkoma Basins (SCOOP, STACK, ARKOMA). As the map shows, the hottest counties were Grady, McClain, and Garvin. Mineral buyers like to follow certain operators, usually the ones drilling the best wells, so it is no surprise that the activity is focused in and around the wells of Continental Resources and EOG Resources.

This map shows all of the Sections, within our 31 county scope, that were acquired in 2019.

WHO

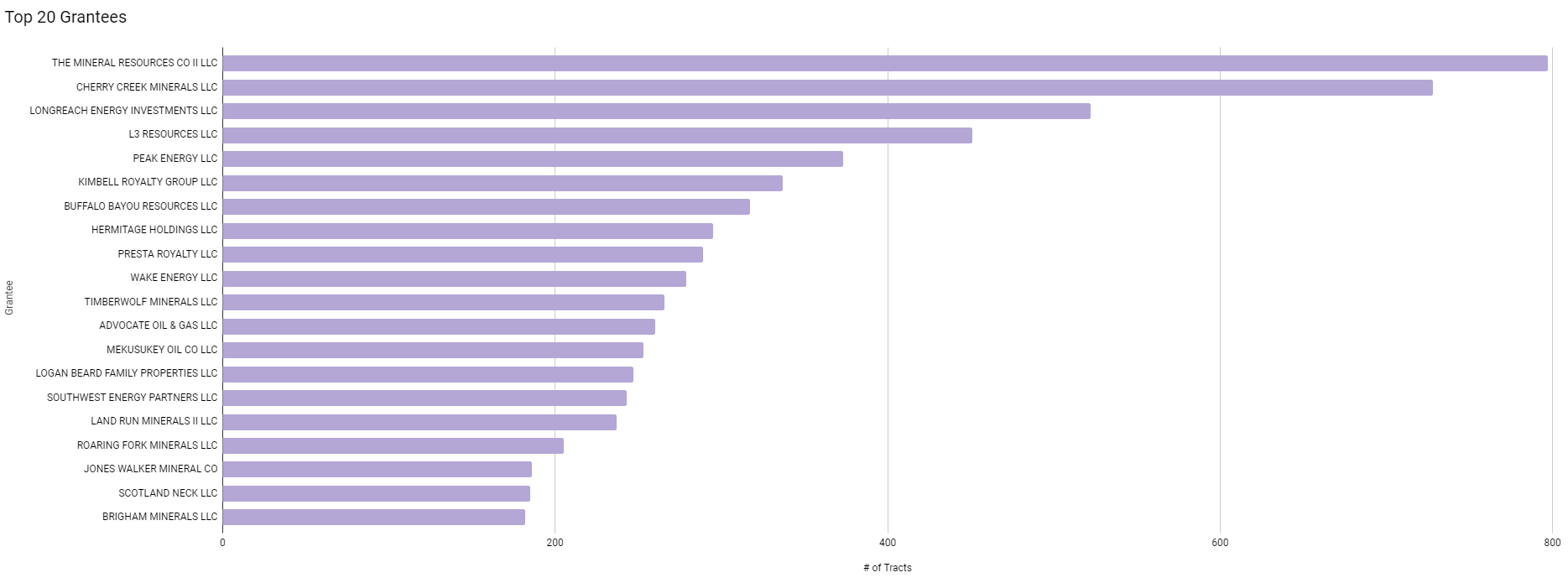

The Top 20 Grantees chart below is based on the number of tracts acquired, not net mineral acres. Obvious family conveyances were removed from the Top 20 to focus our research on companies buying minerals.

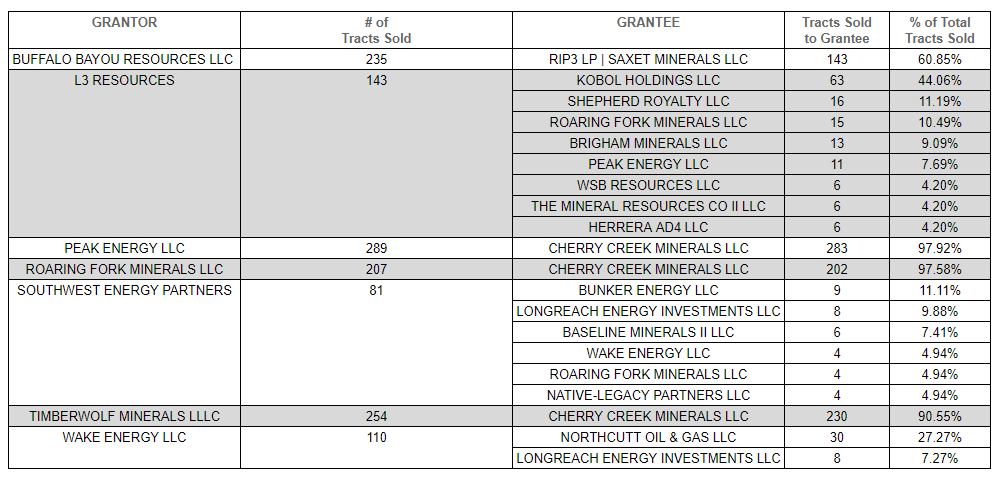

Inputting the Top 20 Grantees as Grantors we can see who is actively divesting. As the below chart illustrates, Cherry Creek Minerals, LLC, an entity related to LongPoint Minerals, is the most popular end-buyer.

HOW MUCH

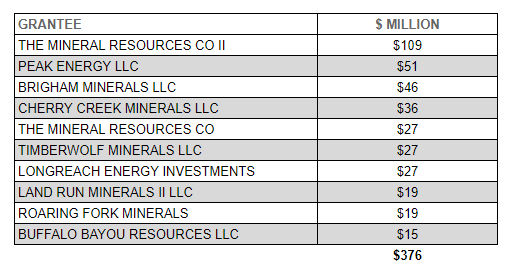

The Top 20 Grantees listed above are based on the number of tracts (Section-Township-Range). Theoretically, someone could be at the top of the leaderboard if they purchased 1,000 tracts that all together, only totaled 1 nma. So the leaderboard is not always the greatest indicator of who is actively buying and spending money. The charts below show which companies are spending the most capital, based on the total consideration recorded. The top 3 buyers are The Mineral Resources Co (a division of Continental Resources), Cherry Creek Minerals LLC (we included Peak Energy, LLC ), and Brigham Minerals LLC.

WHEN

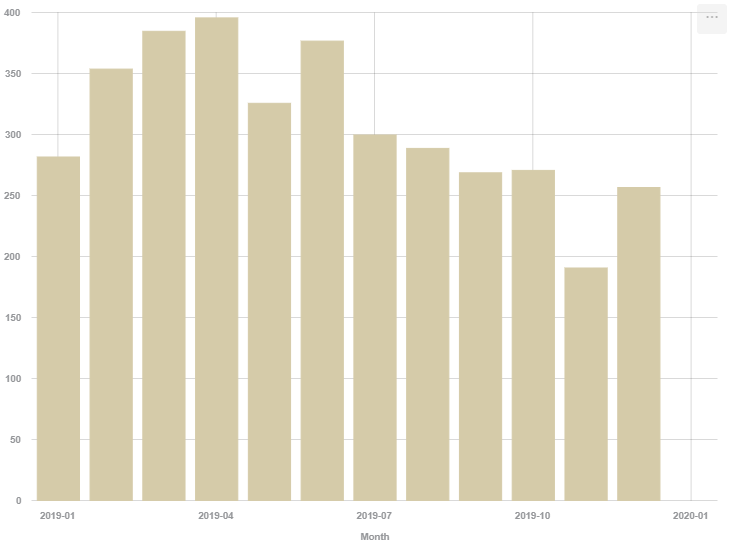

Filtering the Top 10 Grantees based on Consideration, shown above, we then examined the number of tracts acquired over each month. Activity peaked in April and has been steadily declining, bottoming out in November.

CONCLUSION

Oklahoma is experiencing a tough time. Lackluster wells have led to a freeze in the capital, which has caused everyone to pull back their drilling activity. Additionally, a few buyers, as shown above, control the end-buyer market. If the end-buyers are not acquiring, it affects the middle-tiered buyers and hinders their activity. Due to the slow down, a lot of the middlemen, who rely solely on flipping acreage, will likely be looking for new career paths. Gone are the days of being able to buy anywhere in a SCOOP/STACK county and flipping for thousands of dollars of profit.

The slow down also means that mineral prices will decrease. Companies are no longer paying for 4-8 PUDs and are basing their economics on more conservative estimates. Lower price/acre will allow for the smaller, non-private equity-backed companies to be able to compete. The same companies have dominated the leaderboard over the past few years, and with the changing market, we may see some new companies at the top of next year’s list.

2020 will be an interesting year for the industry. Through the ups, downs, and changes, Convey640 will be here, gathering the data daily and presenting the information to our subscribers to help them make data-driven decisions.

Comments are closed